Risk management is a crucial aspect of any investment strategy. It involves identifying, assessing, and prioritizing risks, and then taking steps to minimize, monitor, and control those risks. In the world of investing, risk can come in many forms, including market risk, credit risk, liquidity risk, and operational risk. By understanding these different types of risk and how they can impact your investments, you can make more informed decisions and better protect your portfolio.

One key aspect of risk management is understanding the concept of risk-reward tradeoff. This means that in general, the higher the potential return on an investment, the higher the risk involved. Conversely, lower-risk investments typically offer lower potential returns. By understanding this tradeoff, you can make more strategic decisions about where to allocate your investment capital. Additionally, understanding the concept of diversification is crucial to effective risk management. Diversification involves spreading your investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment’s performance on your overall portfolio.

Setting Limits and Sticking to Them

Setting limits is an essential part of effective risk management. This involves establishing clear guidelines for how much of your portfolio you are willing to risk on any single investment, as well as how much you are willing to lose before cutting your losses and moving on. By setting these limits in advance, you can avoid making impulsive decisions based on emotions or short-term market fluctuations. It’s important to stick to these limits once they are set, even if it means missing out on potential gains. This discipline is crucial for long-term success in investing.

Another important aspect of setting limits is establishing a clear investment plan and sticking to it. This plan should outline your investment goals, risk tolerance, and time horizon, as well as specific criteria for buying and selling investments. By following this plan consistently, you can avoid making hasty decisions based on fear or greed. Additionally, setting limits can help you avoid overtrading, which can lead to higher transaction costs and lower overall returns.

Analyzing Probabilities and Making Informed Decisions

Analyzing probabilities is a key part of effective risk management. This involves assessing the likelihood of different outcomes for each investment and using this information to make more informed decisions. One common tool for analyzing probabilities is the use of historical data and statistical analysis to identify patterns and trends in the market. By understanding these patterns, you can make more accurate predictions about future market movements.

Another important aspect of analyzing probabilities is understanding the concept of expected value. This involves calculating the potential return on an investment based on the probability of different outcomes. By comparing the expected value of different investments, you can make more strategic decisions about where to allocate your capital. Additionally, understanding the concept of standard deviation can help you assess the level of risk associated with different investments. Standard deviation measures the degree of variation from the average return, and by considering this factor, you can make more informed decisions about how much risk you are willing to take on.

Diversifying Your Bets to Spread Risk

Diversification is a crucial aspect of effective risk management. This involves spreading your investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment’s performance on your overall portfolio. By diversifying your bets, you can minimize the impact of market fluctuations and reduce the overall level of risk in your portfolio.

One common way to diversify your investments is by allocating your capital across different asset classes, such as stocks, bonds, and real estate. Each asset class has its own unique risk-return profile, and by spreading your investments across these different classes, you can reduce the overall level of risk in your portfolio. Additionally, diversifying across different industries and geographic regions can help further spread risk by reducing the impact of sector-specific or regional market movements on your portfolio.

Using Stop-Loss Orders to Protect Your Investments

Stop-loss orders are a valuable tool for protecting your investments from significant losses. A stop-loss order is a predetermined price at which you will sell a security to limit your losses. By using stop-loss orders, you can protect yourself from emotional decision-making during periods of market volatility and ensure that you stick to your predetermined risk limits.

One key benefit of using stop-loss orders is that they can help you avoid significant losses during periods of market downturns. By setting a stop-loss order at a predetermined price below the current market value, you can limit your potential losses if the security’s price begins to decline. Additionally, stop-loss orders can help you avoid making impulsive decisions based on fear or greed by providing a clear plan for when to sell an investment.

Learning from Mistakes and Adapting Your Strategy

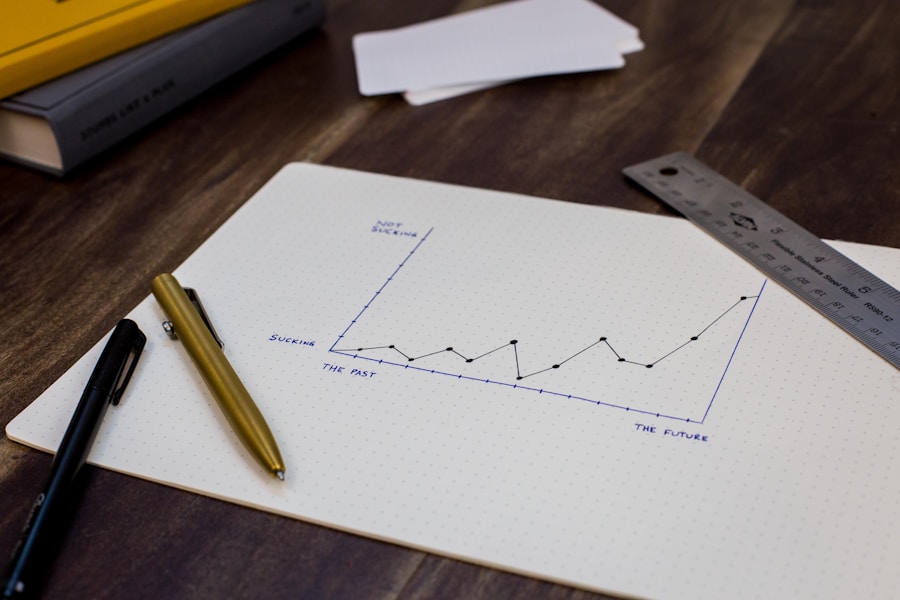

Learning from mistakes is an essential part of effective risk management. No investment strategy is foolproof, and it’s inevitable that you will experience losses at some point in your investing journey. By reflecting on these losses and understanding what went wrong, you can adapt your strategy to minimize the likelihood of similar mistakes in the future.

One key aspect of learning from mistakes is maintaining a growth mindset. This involves viewing losses as opportunities for learning and growth rather than as failures. By adopting this mindset, you can approach setbacks with resilience and use them as opportunities to refine your investment strategy. Additionally, seeking feedback from other investors or financial professionals can provide valuable insights into areas for improvement in your strategy.

Seeking Professional Advice and Guidance when Necessary

Seeking professional advice and guidance is an important aspect of effective risk management. While it’s possible to manage your investments independently, there are times when seeking input from a financial advisor or other professional can provide valuable insights into managing risk and making more informed decisions.

One key benefit of seeking professional advice is gaining access to expertise and experience that may not be available to individual investors. Financial advisors have a deep understanding of market dynamics and investment strategies that can help you navigate complex financial markets more effectively. Additionally, financial advisors can provide personalized guidance based on your individual financial situation and goals, helping you develop a more tailored investment strategy.

In conclusion, effective risk management is a crucial aspect of successful investing. By understanding the basics of risk management, setting limits and sticking to them, analyzing probabilities, diversifying your bets, using stop-loss orders, learning from mistakes, and seeking professional advice when necessary, you can better protect your investments and make more informed decisions about where to allocate your capital. While there are no guarantees in investing, by implementing these strategies, you can increase the likelihood of long-term success in achieving your financial goals.